Funding

Startup Funding

Generally there are 5 Stages of Startup /Business Funding

1) Seed Capital

This is typically the very first investment of money used to for market research and developing product.

It can come from the founder’s personal savings or from "Friends & Family"

Seed capital can be received as a loan on in exchange for common stock. It is also important for later rounds not to have a lot of people on your capital table. Therefore, It is recommend that you create a new LLP, and everyone who invests in your friends and family round becomes a member of the new LLP and makes a capital contribution to the new LLP, and then the LLP makes one investment into your startup. During the friends and family stage, I usually see an investment made from $10,000 to $50,000. It is critical not to give up too much equity. Typically, I would expect to see 5% issued at this stage.

2) Angel Investor Funding

Since seed capital is sometimes limited, it is often necessary for an entrepreneur to tap into wealthy individuals outside their friends & family - this is often called an "Angel" investor.

Majority cases Angel investments are done on emotional grounds, like finding themselves in you, strongly believing in concept, having strong faith in founder.

You can receive money from an angel investor as a loan that is convertible to preferred stock (often it converts to the Series A round of stock below).

Friends & Family investors sometimes participate in this "Angel Round" of financing.

3) Venture Capital Financing (Series A, Series B, Series C Rounds, etc.)

Venture capital (VC) funding is typically used by companies that are already distributing/selling their product or service, even though they may not be profitable yet.

If the company is not profitable, the venture capital financing is often used to offset the negative cash flow.

There can be multiple rounds of VC funding and each is typically given a letter of the alphabet (A followed by B followed by C, etc.)

The different VC rounds reflect different valuations (e.g. if the company is prospering, the Series B round will value company stock higher than Series A, and then Series C will have a higher stock price than Series B).

If a company is not prospering, it can still get subsequent Series-rounds of financing, but the valuation will be lower than the previous series: this is known as a "down round".

These rounds may also include "strategic investors:" investors who participate in the round and also offer value such as marketing or technology assistance.

In the Series A, B, C, etc. rounds of financing, money is typically received in exchange for preferred stock (as opposed to the common stock that insiders/seed capital sources (and perhaps even angel investors) receive).

4) Mezzanine Financing & Bridge Loans

This round is the final raise before going public. In the mezzanine round, a company is valued over several hundred million if not over a billion. At this point, the company has several hundred employees and is operating in more than one country, At this point, companies may be eyeing at an Acquisition of a Competitor or a management buyout

To do so, they can tap into mezzanine financing or "bridge" financing.

Mezzanine financing is often used 6 to 12 months before an IPO and then the IPO's proceeds are used by the company to pay back the mezzanine financing investor.

5) IPO (Initial Public Offering)

Finally, companies can raise money through selling stock to the public in what's called an Initial Public Offering…or IPO.

The IPO's opening stock price is typically set with the help of investment bankers who commit to selling X number of the company’s shares at Y price, raising money for the company.

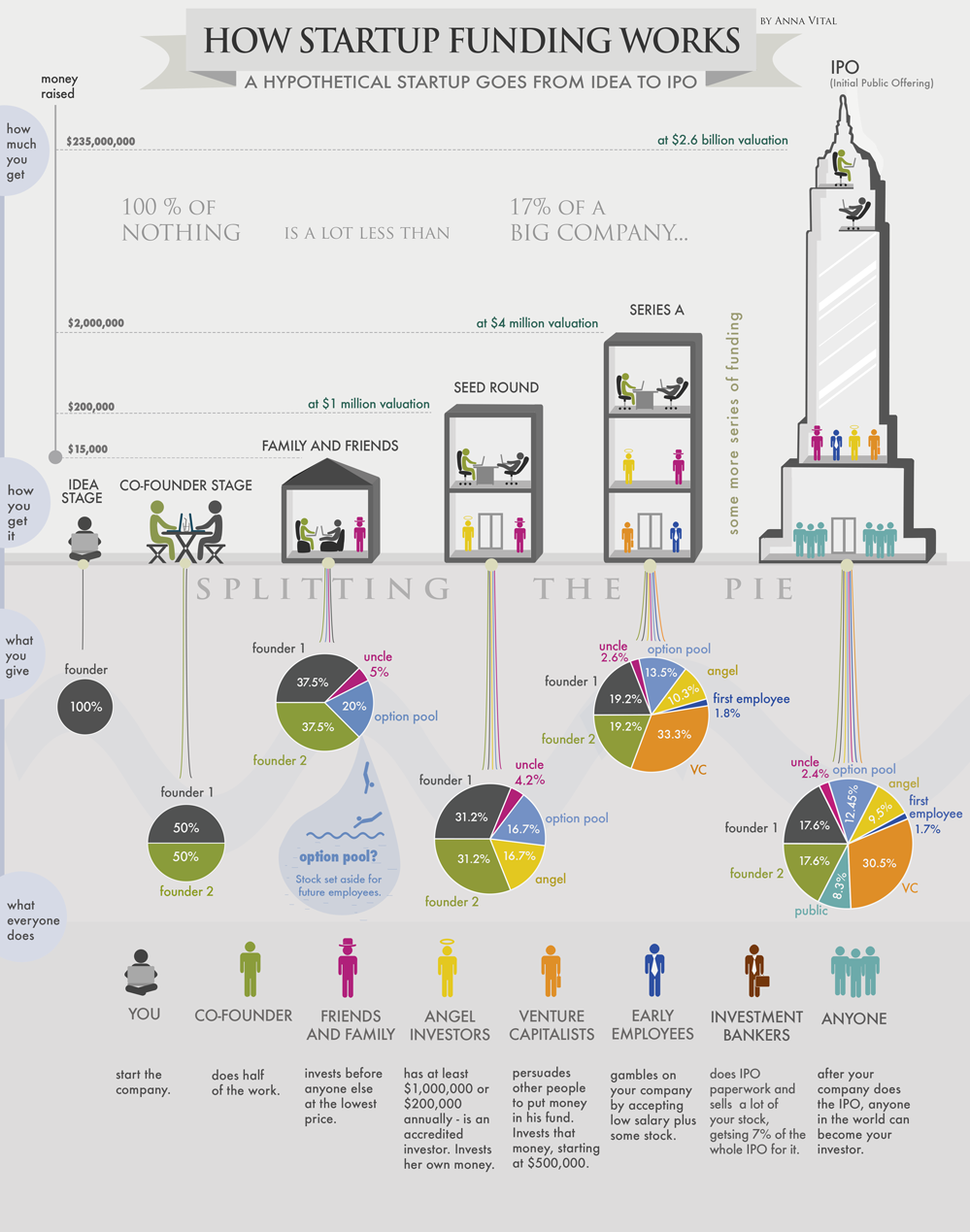

Refer this diagram from Internet showing different stages of a startup, who gets involved and when. For better understanding have a detailed look into it.