How To Create Traction While Pitching Investors, And Some Common Mistakes To Avoid.

Traction is one of the most critical elements to get right when pitching investors. The problem is, most startups do a poor job describing it, investors see thousands of deals each year so they want to make sure that everything is working and headed in the right direction, this is your chance to give them a reason to believe in you, there’s just a few things we need to get right and some common mistakes to avoid.

Traction

Investors want to hear about it and start-ups definitely want to talk about it but let’s make sure you’re talking about the right traction at the right times during your pitch, as we get into this remember to talk about traction over time and not just an instance in time, investors like to see trend lines, not points, let’s get into the traction you can cover during your pitch.

1.Pre Product Traction

You should always start your pitch with pre-product traction, you can talk about the number of customers you’ve met with, the number of design partners you’re working with, the number of customers that said they would trial or buy your product or customers who confirmed your pricing is spot on and they have a willingness to pay. You can also talk about the traction around the number of signups for early access to your product or beta and results from online ads/ smoke tests. If your product, your website, your beta offering isn’t built out yet but you’re proving interest and intent to purchase through the smoke test the important point not to miss is to talk about your intellectual property, 90% cases investors say yes if you have and IP and show growth around the IP.

2.Pre Revenue Traction

Let’s say you have the product but you’re not yet at revenue, you could talk about traction around your pipeline showing the number of pilots and trials preferably paid that are in process and the results of those pilots and trials, let’s say you’re a B to C company, you could highlight the number of users, signups, downloads or the engagement, if you’re paying for those downloads you’ll need to be ready to address what you’re spending to get that traction. Finally, if you’re working on a product where you need regulatory approval like in the healthcare industry you can discuss where you are on your trials and in your approval pathway.

3.Revenue Stage Traction

Now let’s say you’ve crossed that magical threshold and you’re at revenue, what’s important to highlight for investors is about your MRR(Monthly recurring return) and ARR( Annual recurring return) and make sure to discuss your projected CAC ( Customer Acquisition Cost) to long term value (LTV) ratio, you can talk about traction around the number of customers you have or your user retention, as well you can talk about traction and date around the engagement of your customers in your B to C product, if you’re using a freemium model you can talk about the traction around your conversion rates, in B to B if you are using a land and expand strategy you want to show evidence that that’s working or will work.

Projection Stage Traction

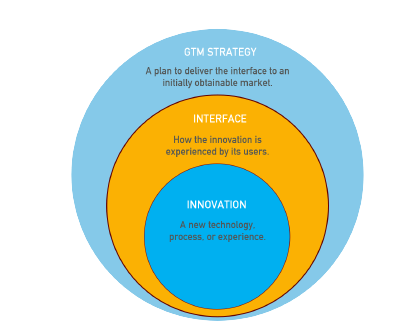

Now that we’ve covered what traction points you should be covering and when should you talk about it, I like to see a traction slide about ¾ of the way through the deck so you’ve laid out this storey and you started to describe the problem, the solution, the competition, total addressable market (TAM), Go to market strategy GTM) and then you bring up the traction this shows how it’s all coming together. While your traction overtime around revenue is most important, you can also walk investors through your sales pipeline from leads to closed sales, cover important items like the number of customers in each phase, the percent transitioning between phases, the time between phases and value of each deal. Whatever you do, make it clear how your sales strategy is progressing.

You don’t need to wait to do a big reveal of your traction instead you can drip bits of traction throughout your pitch to give evidence that things are working. When you’re talking about your problem statement you could drip in a bit of traction around the number of customers that you’ve met with who specifically validated yes! They have that problem, maybe we were talking about your solution, you can say the number of customers that have already moved forward, you’re not telling them the revenue around that but you’re just giving investors an indication of how many people agree that this is a solution. While going through a competition slide you could talk about the top two or three key differentiators and benefits on your competition slide how frequently you’re winning based on that.

One last example might be on your Go To Market Strategy, are you making progress on your initial customer segment instead of waiting for the big reveal 10 minutes later in your deck you could just address lightly the number of customers that you’ve already secured in that initial customer segment, but don’t overdo the drip, use it sparingly, you want to leave some drama mystery for your full traction slide as you tell your story to investors.

I want to hit some power tips and huge mistakes we see start-ups make. Realise, for investors, there’s a ranking of traction they care about, The number one type of traction most investors care about is revenue and profitability, they least care about the best places to work, award winnings, recognitions that you’ve had. Look, if you have great revenue growth and your lighting it on fire and you want to talk about the best places to work, that’s terrific, it’s the icing on the cake but if all you have is just the icing on the cake realise investors really don’t care that much about it.

Some other common start-up mistakes that we see that you definitely want to avoid first would be artificial traction manipulation, that’s where you’re already doing a spend with things like Google Ad words or Facebook ads and then suddenly you goose it, you jam more cash into your page spend unnaturally just to make your traction look better if you’re doing that be ready to talk about it with investors because they’re going to dive in and ask questions if suddenly there was some artificial manipulation that occurred to make your traction look better than it actually is.

Next up, the faux traction logo wall. Don’t put up a slide of logos trying to pass them off as paying customers when they’re not instead be transparent and be clear. Don’t commingle a handful of paying customers with a slide full of logos that are only people you are talking to instead show your sales pipeline show the different companies that are on the customer journey with you from lead to closed sales.

Another common mistake is mixing in traction from other products and services, do the world a favour if your pitch is been focused on one particular product don’t mix in traction from legacy products or consulting services you’ve been offering, when you’re talking about traction be focused on the traction for that product don’t try to glom in another traction and make things look bigger than they actually are.

Last common mistake is revenue traction that’s mischaracterised, look if you have a mixture of recurring and non-recurring revenue make sure to segment that out, don’t just talk about revenue and try to hide it and make it look like it’s all recurring, so if you’re selling a product that has implementation fees that occur one time or one-time hardware costs segment that out and talk about your recurring versus your non-recurring revenue again. Be clear and transparent with investors and be prepared to face some tough questions.